Land Revenue Systems In British India Ryotwari system

Land Revenue Systems In British India - Ryotwari, Mahalwari

Ryotwari system

- This system of land revenue was instituted in the late 18th century by Sir Thomas Munro, Governor of Madras in 1820.

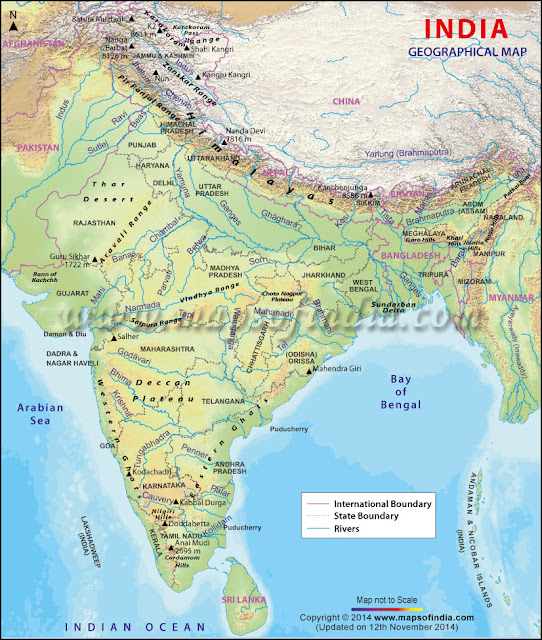

- This was practised in the Madras and Bombay areas, as well as Assam and Coorg provinces.

- In this system, the peasants or cultivators were regarded as the owners of the land. They had ownership rights, could sell, mortgage or gift the land.

- The taxes were directly collected by the government from the peasants.

- The rates were 50% in dryland and 60% in the wetland.

- The rates were high and unlike in the Permanent System, they were open to being increased.

- If they failed to pay the taxes, they were evicted by the government.

- Ryot means peasant cultivators.

- Here there were no middlemen as in the Zamindari system. But, since high taxes had to be paid only in cash (no option of paying in kind as before the British) the problem of moneylenders came into the show. They further burdened the peasants with heavy interests.

Mahalwari system

- The government of Lord William Bentinck, Governor-General of India (1828 to 1835) introduced the Mahalwari system of land revenue in 1833.

- This system was introduced in North-West Frontier, Agra, Central Province, Gangetic Valley, Punjab, etc.

- This had elements of both the Zamindari and the Ryotwari systems.

- This system divided the land into Mahals. Sometimes, a Mahal was constituted by one or more villages.

- The tax was assessed on the Mahal.

- Each individual farmer gave his share.

- Here also, ownership rights were with the peasants.

- Revenue was collected by the village headman or village leaders.

- It introduced the concept of average rents for different soil classes.

- The state share of the revenue was 66% of the rental value. The settlement was agreed upon for 30 years.

- This system was called the Modified Zamindari system because the village headman became virtually a Zamindar.

Consequences of the British land revenue systems

- Land became a commodity.

- Earlier there was no private ownership of land. Even kings and cultivators did not consider land as his ‘private property’.

- Due to the very high taxes, farmers resorted to growing cash crops instead of food crops. This led to food insecurity and even famines.

- Taxes on agricultural produce were moderate during pre-British times. The British made it very high.

- Insistence on cash payment of revenue led to more indebtedness among farmers. Moneylenders became landowners in due course.

- Bonded labour arose because loans were given to farmers/labourers who could not pay it back.

- When India achieved freedom from colonial rule, 7% of the villagers (Zamindars/landowners) owned 75% of the agricultural land.

Comments

Post a Comment